Looking to accept crypto payments as a small business? This can be a great opportunity to stay ahead of the curve and tap into a growing market of cryptocurrency users. With an increasing number of consumers using cryptocurrency for purchases, and much more planning to do so in the future, the ability to accept crypto payments can provide a competitive edge and tap into a growing market.

Cryptocurrency has seen a significant rise in popularity over the past few years, with many consumers turning to digital currencies as a way to make secure, fast, and decentralized transactions. According to a recent study, up to 30% of cryptocurrency owners already use crypto for purchases, with most planning to make purchases with crypto in the future. With this in mind, it’s clear that accepting crypto payments as a business can be a smart move that positions your business for sustainable success.

This guide will walk you through the process and explain how to accept cryptocurrency as payment, from understanding the basics of crypto transactions to setting up the necessary infrastructure to process them.

What are crypto transactions and how are they different from traditional banking?

Unlike fiat currencies, crypto operates on a peer-to-peer network, allowing for direct transactions between users without the need for a middleman, such as a bank. Transactions are recorded on a public digital ledger called a blockchain, which allows for transparency and security. For these reasons, crypto transactions have numerous advantages that we can show in the following table:

| Cryptocurrency Transactions | Traditional Transactions |

| Decentralized, no need for a middleman such as a bank | Centralized, typically involving a bank or other financial institution. |

| Faster, transactions can be completed in minutes | Slower, transactions can take several days to complete |

| Transaction fee for accepting cryptocurrency payments are lower, as there is no intermediary | Higher fees, as banks and other financial institutions charge for their services |

| Transactions can be made without revealing personal identity | Require personal identification, transactions are linked to individuals |

| More secure, as transactions are recorded on a public digital ledger | Vulnerable to fraud and hacking, as personal information is stored by financial institutions |

As we can see, accepting crypto payments can actually be beneficial. If you are still considering should your small business accept cryptocurrency or not, the answer seems to be obvious.

In the next chapter, we will get through the process of setting up crypto payments, including creating a crypto wallet and integrating it with your business’s payment system.

Setting up a crypto wallet

Wondering “how can my business accept cryptocurrency payments”? The first step in accepting cryptocurrency is to set up a crypto wallet. There are two main options for doing this: creating a wallet through a decentralized platform like MetaMask or creating an account on a centralized platform like Kraken.

Which platform to choose?

By using a decentralized platform like MetaMask, you may build a private wallet that is entirely in your control. This implies that you are in charge of keeping your own money and private keys secure. This also implies that you are not bound by any centralized platform’s terms and conditions.

On the other hand, a centralized platform like Kraken serves as a custodian for your money, which means that they are in charge of keeping your money and private keys secure. Since you no longer have to manage your own private keys, this may be more convenient for some users. The terms and conditions of the platform, which are subject to change without prior notice, also apply to you.

To make it simple:

| Centralized platforms | Decentralized platforms |

| Convenience | Control |

| User-friendliness | Autonomy |

| Support | Transparency |

It will ultimately come down to your personal choices and the level of security you are comfortable with when deciding which type of platform to use.

Creating a MetaMask wallet

If you have decided to go for a decentralized platform, here is what you need to do.

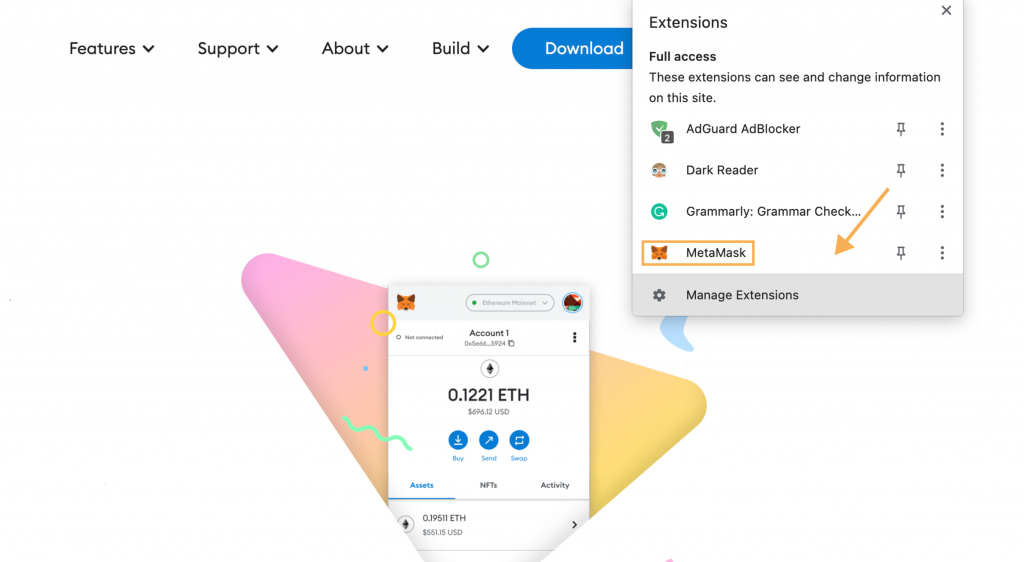

- Go to the MetaMask website, and click on the “Get MetaMask” button to download the extension for your preferred browser (supported by Chrome, Firefox, Opera, Brave, Edge). You can also use a mobile version.

- Once the extension is installed, click on the MetaMask icon in your browser to open the extension.

- Click on “Create a Wallet”

- Now you just need to follow the instructions. Read and accept the terms and conditions, then click “Create”, set a strong password for your wallet and click “OK”.

Important! Write down your seed phrase and store it in a safe place. This seed phrase is the only way to recover your account if you lose access to it.

- You’ll need to verify your seed phrase by clicking “Next” and selecting the correct words in the correct order.

Now, your MetaMask wallet is now set up and ready to use.

Creating a Kraken account

- Go to the official Kraken website.

- Click Create Account in the upper-right corner.

- Fill in your email address, a username (which cannot be changed later), and a password. Tick the box confirming you agree with the Terms of Service and Privacy Policy, and then “Create account”

- Go to your email box and click the activation key that you’ve received from Kraken.

- Confirm your password, fill in the captcha if asked, and click Activate Account.

You are ready to go!

Sharing a wallet address

Now that you have set up your crypto wallet, it’s time to guide you through the process of getting peer-to-peer (P2P) crypto payments.

For MetaMask, click “…” next to the account name and select “Account details”. You will see the QR code displayed and a long address with numbers and letters. Both can be used to transfer crypto to your account.

Attention! It is really important to use the same network as stated in your MetaMask account. For example, in the picture we are using BNB Smart Chain, so when the coins are sent the sender must choose BNB Smart Chain. Otherwise, the money will not be transferred and can be lost.

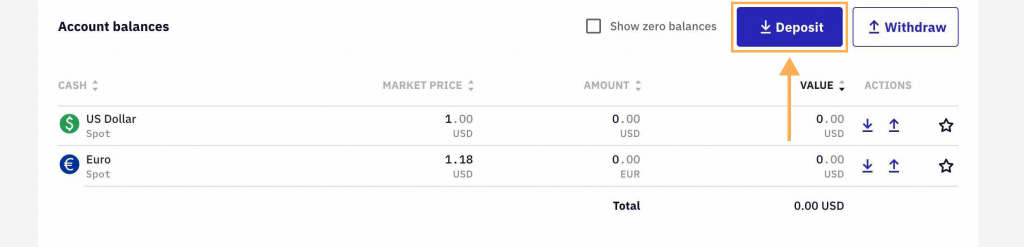

For Kraken, go to the Funding tab

Then click “Deposit”

And choose a coin you’d like to charge customers in. For example, we chose USDT as it’s the most popular stablecoin. Here you can see the Wallet Address and a QR code that you can share.

Do not forget to select a Network. As in the previous case, network type really matters here, and it’s important to mention this to buyers. In our example, we chose the TRC20 network as it tends to be the cheapest for transactions. In this way, the costs of accepting crypto payments will be the lowest.

That’s it! By sharing your wallet address with customers, you are able to accept crypto as a merchant.

QR codes can be placed on your Point Of Sale or on the website, at the check-out section. Once the funds are deposited into your account, you will receive an email about a successful deposit.

What to do next?

You are probably thinking about what to do with this crypto once you got it. There are several options:

- Leave it on your crypto wallet. In case you want some crypto on your account for holding or trading.

- Convert received crypto into a stablecoin. If you are worried about the volatility of crypto, it’s better to transfer all received crypto in coins like USDT, USDC, etc. In this way, even after a year, the equivalent of money you received in USD will stay the same.

- Use a P2P (peer-to-peer) exchange to get fiat instead of crypto. There are several ways to do it, but we can recommend Obmify – a monitoring service that has a list of reputable and safe exchanges that work with a variety of cryptocurrencies.

Which coins to accept?

It’s crucial for small businesses to think carefully about the currencies they will accept as payment. The more coins you accept, the larger the pool of potential customers your company can draw from. Not all coins are made equal, though, and some might be more well-known and often used than others.

Stablecoins are presently among the most widely used coins for payments. In order to lessen the volatility of the coin’s value, a stablecoin is a type of cryptocurrency that is tied to the value of an asset, such as the US dollar. Stablecoins are therefore a desirable option for businesses and consumers, as they are less subject to jarring price changes.

The common stablecoins are Tether (USDT), USDC, BUSD, and DAI.

Also, consider accepting the more well-known coins like Bitcoin (BTC) and Ethereum (ETH) in addition to stablecoins. These currencies have a long history and a huge user base, making them a secure choice for companies. Additionally, they have a solid track record of security and stability.

Final thoughts

In conclusion, accepting crypto payments as a small business can provide a competitive edge and tap into a growing market of cryptocurrency users. With the increasing popularity of digital currencies, the ability to accept crypto payments can be a smart move that positions your business for sustainable success. Don’t miss out on this opportunity to stay ahead of the curve and provide your customers with the fast, secure, and decentralized transactions they desire. Start accepting crypto payments today and see the benefits for yourself.

Bonus: How to get even more customers once you start accepting crypto?

If you want to be part of the growing crypto market, we invite you to join BitcoinWide – an online directory that gathers businesses accepting crypto as a form of payment. By being listed on BitcoinWide, you will be able to reach a wider audience of crypto users, which could potentially bring you a lot of customers.

What will BitcoinWide give to your business?

- Increased Visibility: Get a wider audience of crypto users and convert them into your customers.

- Competitive Edge: Stay ahead of the curve and dive into a growing market of crypto users.

- Targeted Audience: Attract a specific and interested audience to your business.

It’s totally free to get started and will only take a few minutes to add your business to the online catalog. Don’t miss out on this opportunity to stay ahead of the curve and reach a new market of customers.

2 Comments

Jess

This is really a very useful article for businessmen, and I encourage everyone to read it. I would like to see more and more businesses start accepting cryptocurrency

Tosha

Excellent innovative solution